The Ultimate Chinese Shopping Spree

Celebrated annually on November 11, Singles’ Day has become one of the largest shopping events globally. In 2023, sales reached an astonishing ¥1138.6 billion (approximately $160 billion) in gross merchandise value (GMV), far surpassing Amazon’s Prime Day by more than 10 times and nearly tenfolding U.S. spending on Black Friday.

This year, Tmall kicks off its pre-sale on October 14 at 8 PM. Notably, 2024 marks the longest pre-sale period yet, generating significant anticipation even before the official event on November 11. As of October 30, 2024, sales for the first 16 days of Double 11 across all platforms have reached ¥845 billion ($119 billion).

Record-Breaking Pre-Sales

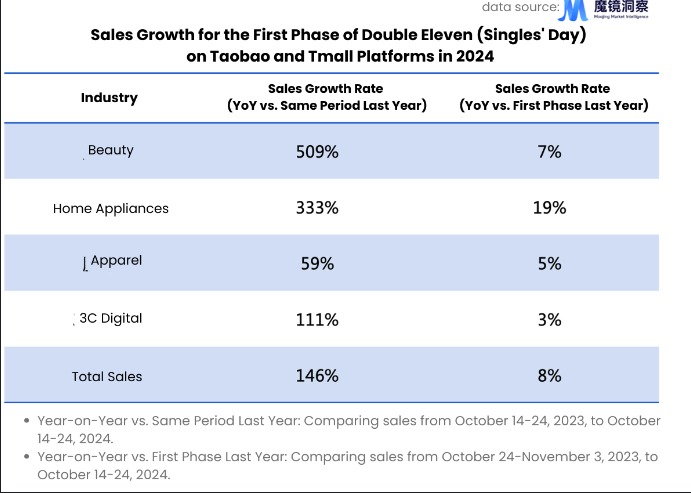

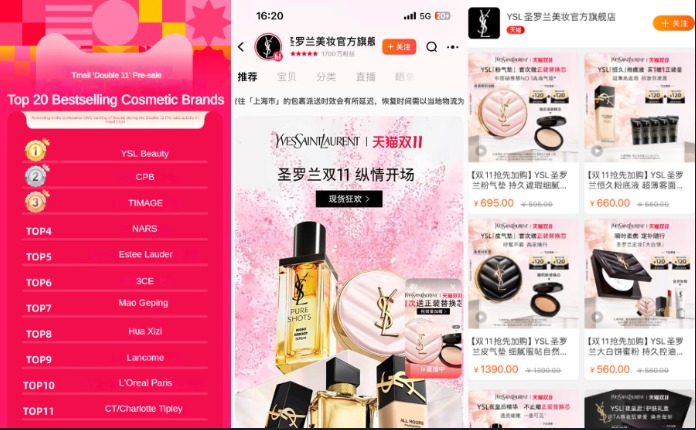

In just the first 10 minutes of the pre-sale, over 100 beauty brands saw sales skyrocket on platforms like Tmall and JD.com. Brands such as Lancôme, Helena Rubinstein, and Clarins achieved over ¥100 million (approximately $14 million) in sales within those first 10 minutes. By the half-hour mark, 20 brands reached this milestone, and within 4 hours, Tmall had 40 beauty brands surpassing ¥100 million in sales. L’Oréal led the charge, claiming the top spot in Tmall’s first-day sales rankings for fast-moving consumer goods.

On the opening day, over 12,000 brands reported sales growth exceeding 100%, with nearly 6,000 brands experiencing increases over 500%. In the apparel sector, 125 brands doubled their sales compared to last year’s pre-sale, with Kappa experiencing an incredible increase of over 1,300%.

$4.2 Billion | A Discount-Driven Double 11

In an environment of tightening budgets, consumers are increasingly drawn to substantial discounts, reflecting a pronounced “lipstick effect.” According to a report by China News Weekly, 46.7% of consumers are more inclined to make purchases due to significant discounts.

After years of complex discount structures, many e-commerce platforms are simplifying their approaches with straightforward low-price strategies. Tmall President Jia Luo emphasized “maximum investment,” revealing that Tmall has ramped up its investment this year, offering standardized discounts along with a massive ¥30 billion (approximately $4.2 billion) in consumer vouchers and red envelopes to enhance shopping value.

Additionally, exclusive high-value coupons for 88VIP members and substantial discounts across various categories, including beauty and electronics, are set to drive sales. On the live streaming front, Tmall is distributing ¥1 billion (about $140 million) in coupons, allowing consumers to claim up to ¥1,500 (around $210) daily.

Navigating China’s Double 11 | How Brands Can Prepare for Global Shopping Festivals

As global shopping habits evolve, two key trends are emerging: an unprecedented commitment to value-driven pricing and a competitive e-commerce landscape where traditional retailers vie for consumer attention against new technologies. Here’s how luxury brands can seize the opportunity and get inspired through Double 11:

The Lipstick Effect: Affordable Luxuries Shine

The “lipstick effect” suggests that during economic uncertainty, consumers gravitate toward small, affordable luxury items. Data from Tmall and Taobao indicates that popular categories include designer toys, pet products, and niche home appliances, with 284 brands achieving sales exceeding $14 million by October 24. Beauty, fashion, sports, and tech products are seeing notable growth this year.

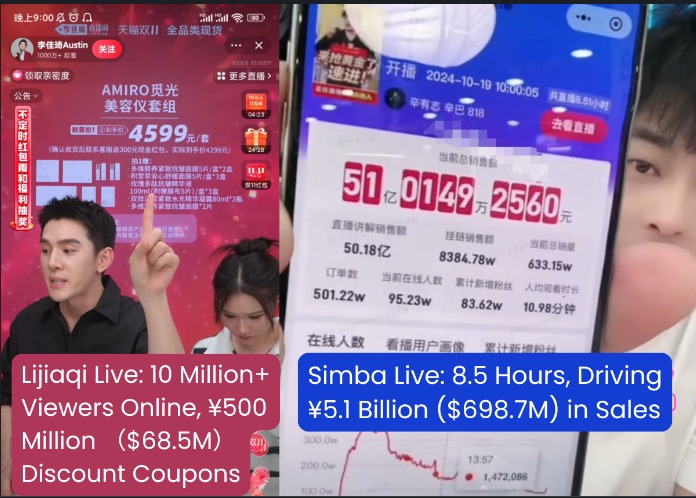

KOL and Live Streaming: Driving Engagement

As competition heats up among platforms, Key Opinion Leaders (KOLs) and live streaming are making a strong comeback. Li Jiaqi, a leading KOL, launched his return by distributing ¥500 million (about $70 million) in red envelope coupons during live sessions and according to data released by Simba on the evening of October 19, during 8.5 hours of live streaming, sales exceeded ¥5.1 billion ($698.7M), with 952,300 viewers watching the livestream, showcasing how effective this strategy can be. Brands like La Roche-Posay, Valentino, and L’Oréal have seen impressive sales through these channels.

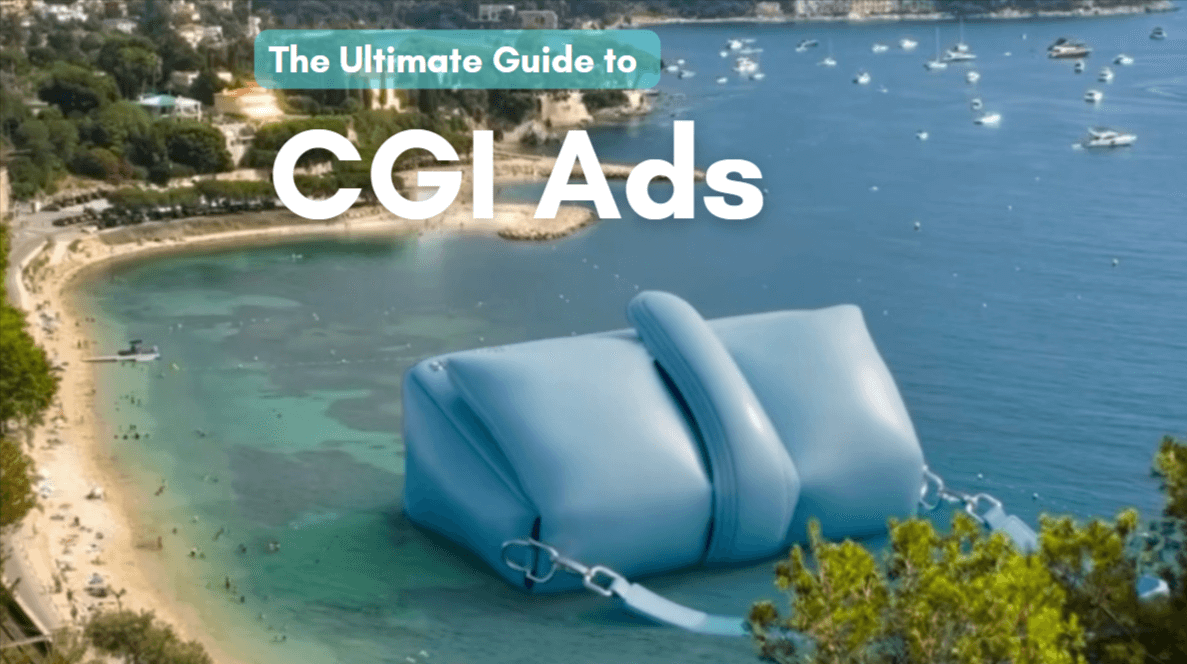

Harnessing Generative AI: Innovating Content Production

Last year, AI technology began enhancing shopper interactions. Alibaba’s AI chatbot, Wenwen, has served over 5 million users, providing personalized shopping recommendations. Luxury brands like Valentino and Prada are leveraging generative AI in their marketing efforts to streamline visual content production. Steven Zhang, CEO of Kivisense, highlighted a significant boost in image production efficiency through AI-enabled virtual shooting, leading to a substantial reduction in costs.

Emotional Fulfillment: Meeting Consumer Desires

Kaitlin Zhang, CEO of Oval Branding, notes a growing trend towards “emotional fulfillment” in purchases. Products perceived as indulgent offer both tangible value and emotional satisfaction. For instance, Jellycat’s Tmall flagship store saw sales in one minute surpassing last year’s total first-day sales, with a remarkable 230% increase within two hours.

Expanding Regional Markets: Hong Kong and Macau

As Tmall and JD.com prepare for the 2024 Double 11 shopping festival, markets like Hong Kong and Macau are emerging as new competitive fronts. With over a million expatriates from mainland China residing in Hong Kong, these consumers represent a valuable demographic for e-commerce. Early data shows that new user acquisition on Tmall Hong Kong doubled compared to last year, with transaction totals increasing sixfold, and JD’s Double Eleven kickoff in Hong Kong and Macau saw sales surge by 300% in just four hours.

Double 11 Sales Rankings: A Strong Start

As of October 30, 2024, total sales for the first 16 days of Double 11 across all platforms have reached ¥845 billion (approximately $119 billion). By October 24, 284 brands had surpassed ¥100 million (about $14 million) in sales, highlighting significant growth opportunities. With Tmall announcing its leading brands and merchants, it is evident that while Singles’ Day originally celebrated singlehood, its ability to drive record sales is now undeniable.

As global brands prepare for their own Black Friday strategies, understanding the dynamics of Double 11 can provide valuable insights. Let’s look forward to even more remarkable sales figures on Double 11 day, and may this article inspire your marketing and branding initiatives!