With technology upgrading, the banking and finance sector is not ready to back down from implementing augmented reality. With the decision to help customers, build a clientele that trusts the financial stakes, and compel consumers to continue growth with the bank, this sector has adopted augmented reality to keep up with the modern world.

Exploring AR In Banking And Finance: How It’s Reshaping Financial Services?

Augmented reality in banking and finance has revolutionized customer interaction. The most important factor in monetary stakes is the trust between the bank and the client. AR has built that by creating a virtual or augmented reality environment where the clients can look up mortgages and loan options alongside interaction with financial service providers.

The augmented reality in banking and finance is not limited to virtual interactions. This entity has exceeded expectations by introducing personalized financial planning and insights for a deeper approach to complex concepts of monetary tasks. Wealth managers can look into investment decisions and stimulate market conditions for creating portfolios.

Some banks have offered an AR-driven marketing campaign. This type of campaign introduced Marker augmented reality with a broader approach. Users can scan QR codes on advertisements and get insights into revealing 3D projects, credit card offers, loan approvals, etc. No more spending extra time in the banks because everything is at the touch of a button.

Top 10 Use Cases And Applications Of AR in Finance Sector

Data Visualization

Data visualization is one of the most crucial factors in the finance sector. This application helps in understanding the technicalities of the financial stakes. From presenting complex stock market trends to investment projections and portfolio performance, users in the finance sector are moving on from traditional charts and spreadsheet presentations. The guru of the finance sector, Salesforce, has invested in building a three-dimensional environment available only through headsets. This method is an immersive experience for users to interact with data streams.

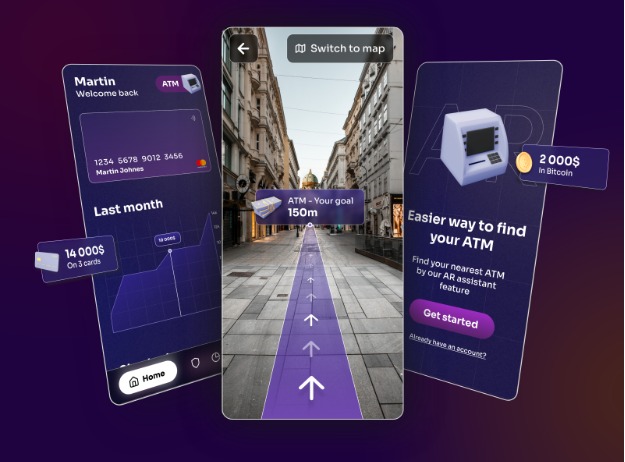

Bank Account Management

Keeping up with financial stakes as a wealth manager is harder than anyone can imagine. The augmentation introduced in this sector is deliberately helping to improve interaction with daily account maintenance. The augmentation can visualize information and help in registering relevant banking cards and checking balance history and spending areas.

Source: FreePik

Virtual Trading

The AR-powered stations have increased the proficiency of the trading sector. Now traders can interact through augmented headsets and review complex data in 3D charts and bars. CitiGroup has introduced a virtual trading desk with Microsoft’s HoloLens. In this entity, the trading users can interact with each other through digital workstations and visualize stock performance with other assets.

Online Payments

Online payments have changed the way people do online purchasing. The augmented reality integration in the banking and finance sector helps users purchase stock, review different investment opportunities, and make quick payments with just a few taps. This method is more efficient than physically reaching the bank and making the payment, often leading to missed opportunities.

Interactive Financial Product Demonstrations

Understanding the complexities of loans and mortgages can be hard. Augmentation has helped in planning retirement savings and projecting the best income sources. Besides that, adjusting variables like contribution levels and investment returns, can impact the future of the user and be enhanced through augmentation implementation.

Data Privacy And Asset Security

One of the leading causes of cybercrime is data breaches. Some banking and financial institutions are using AR and VR for improved security login. Face ID and Touch ID are just a few birds that are getting hit with virtual stones. Alongside that, the biometric verifications and iris of the user is improving the effectiveness of cybersecurity.

Source: FreePik

AR Tools For Budgeting And Investment Education

Most of the traders in the financial departments have budgeting issues including personal and business monetary management. There are personalized budgeting applications integrated with augmentation, the users can preview their financial spending in categories in the form of pie charts or bars. Some AR tools can form complex financial reports and make affecting investment growth and interest rates charts for better understanding.

ATM And Branch Locator

Now there are AR-powered mobile apps that can locate the nearest ATM or branch of the bank. This cutting-edge technology is efficient for individuals who are traveling to new cities for the first time. Not only this, the leveraging technology enhances the banking experience for busy wealth managers and increases client-business trust in the process.

Customer Service And Communication

Communication between the bank and the client is the most important factor for growth in the banking and finance industry. Not only does this prove the authenticity of the financial institutions but also how reliable it is. Banks are now improving customer service and communication through virtual environments. The financial sector is implementing augmentation through a lifelike virtual room for managing meetings to seek financial advice and help from bankers. For all the queries, engagement, services like investment and educating clients, is available through informative visuals.

Virtual Branch Experiences

Customers can now visit the bank without physically being there. Banks like JPMorgan have introduced the experience of visiting a virtual bank branch. This does not limit the approach. The users can wear the headsets and access various services like account management, loan applications, etc. For high-net-worth clients, some banks offer tailored services in the form of augmented reality.

Advantages Of Integrating AR In Finance And Banking

Enhanced Customer Experience

AR helps in demystifying the banking and financial investment processes. From accessing virtual demonstrations to visualizing monetary products, personalized interactions through augmentation have led to higher satisfaction rates.

Improved Operational Efficiency

Some banks want to provide streamlined processes to reduce time and resources. For remote consultations, banks have adopted technological approaches through augmentation to cut operational costs but also improve operational efficiency.

Source: FreePik

Better Decision-Making Through Visual Data Representation

Besides enhancing data visualization, financial professionals can interact with customers through augmented reality in intuitive ways. For making informed decisions, through strategic approaches, augmentation has helped explore data through analytical processes.

Increased Customer Engagement And Retention

For higher levels of customer engagement, banks, and financial institutions want trustworthy connections with bankers, traders, etc. They remain loyal and require a wider range of services provoked by the virtual environment integrated with augmentation.

Challenges Of Using AR in The Finance Sector

Technological Barriers And Implementation Costs

The hardware, software, and training involved in AR technology require a high amount of investment. The potential rise in trends and keeping updated with the AR systems is becoming significantly challenging. The implementation complexity is another necessity that requires robust technical expertise and careful planning.

Privacy And Security Issues Related To AR Applications

Sensitive customer data for personalized experience requires intricacies and technological approaches. The lapse in security can result in reputation damage and financial loss.

Future Trends Of AR Implementation In Banking And Finance

AR in banking and finance has helped traders, wealth managers, investors, and bankers in making smart decisions. Just a three-dimensional preview of the market with bars and charts can enhance the proficient approach users make to the most crucial financial decisions. Not only this, the banking system is said to completely shift augmentation by 2030, shaping the future of traders and bankers alike.

Source: Freepik

Conclusion

The financial sector and investment banking are rapidly evolving and keeping up with the trends alongside growing demand is critical. However, with advancements driven by augmentation-centric approaches, financial institutions are taking matters into their own hands. Kivisense is one of the most advanced try-on businesses that can help in visualizing augmented aspects from all sectors. Make your business future-proof today and become a leader in finance. Contact us now.