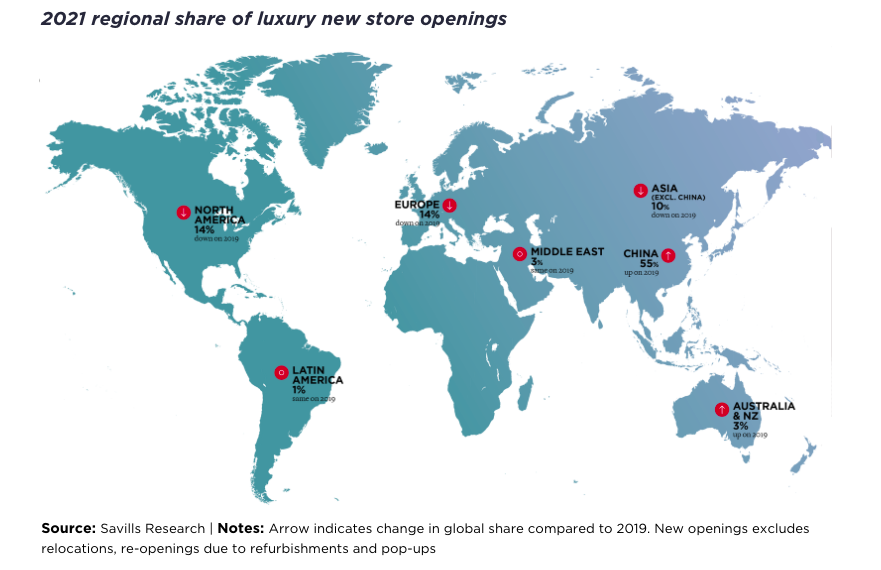

According to British real estate consultants Savills, 55% of new luxury store openings took place in China. With the global pandemic severely restricting international travel, most Chinese consumers chose to buy high-end goods at local luxury retail stores. Bain & Co also reported that 21% of the world’s consumer expenditure in luxury goods was generated in China. Many luxury retailers have to target more high-spending shoppers in mainland China through retail expansion efforts and digital marketing strategies like AR try-on and NFT digital collectibles.

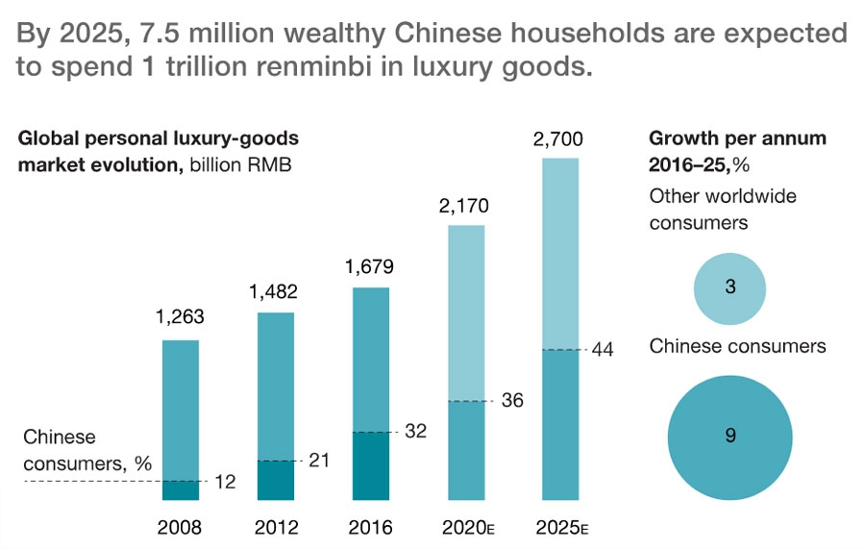

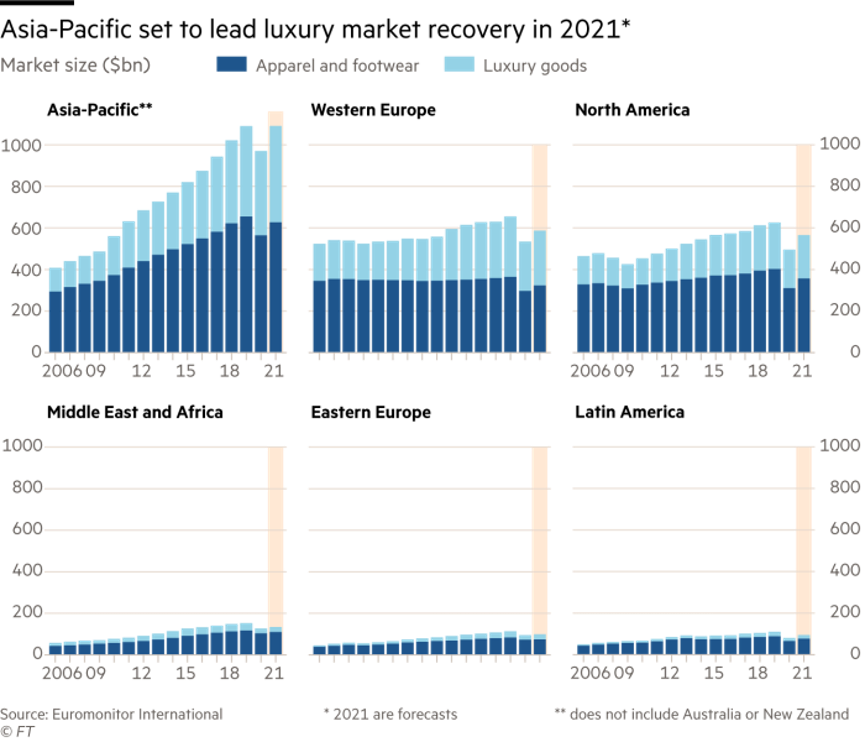

China is Headed to Become the Largest Luxury Market by 2025

In 2021, 16 major luxury retail projects were developed in Shanghai alone, but the renewed surge of COVID-19 in the region might slow down that momentum. China’s strong domestic sales and swift economic rebound will drive higher expansion rates for luxury retailers. Bain & Co said that China will be headed to be the largest luxury market by 2025.

In addition, through innovative digital marketing hacks, such as AR virtual try-on, 3D engagement, AR digital human, AR pop-up store, NFT digital collectibles, etc., the new store openings can engage more Gen Z and improve sales conversion rates.

Marie Hickey, head of research at Savills, also said that the luxury retail trend in China in 2021 is expected to continue this year, with global international air passenger travel slowly returning to pre-pandemic levels, but not before 2025.

14% of All Luxury Store Openings Took Place in Europe

The number of new luxury store openings in Asia outside China declined by 10% in 2021. As in China, the retail openings in the Middle East were surging again, although the region accounts for only 3% of all openings worldwide. These stores were concentrated in communities with populous and relatively affluent neighborhoods, which means Cairo, Saudi Arabia and Bahrain are current opportunity areas for luxury retailers.

Retail sales growth in China and the Middle East has come at the market expense in Europe. Only 14% of all luxury store openings worldwide in 2021 were in Europe, compared with 35% in 2019. This is due to the drop in tourist expenditure during the COVID-19 pandemic and the fact that the luxury market in Europe is more mature than elsewhere. Marie Hickey said the number of international travelers in Europe and North America were expected to recover more quickly, boosting consumer demand for luxury brands.

The number of new stores in North America increased through the end of 2021, suggesting a new wave of retail projects in 2022. In the United States, affluent second-tier cities such as Dallas and Houston lead the way in terms of openings, although New York and Los Angeles typically have high volume of activity. Many luxury retail openings will also implement in-store digitalization experiences, such as AR pop-up stores and AR try-on, to engage more customers and improve brand loyalty.

Enhance In-store Experience with Pomellato AR Digitalization

AR digitalization in Pomellato boutique is a successful example worthy of our reference. Scan the logo of Pomellato at Taikoo Li Qiantan to start your immersive AR experience. Discover the sparkling gemstones world in digital. Virtually try on your desired necklaces or rings and find the perfect one quickly. The delicate luster of its hand-polished jewelry is highly visualized through 3D rendering technology.

With real-time AR body tracking and AI finger circumference measurement, the brand provides customers with perfect try-on effects and effectively boosts sales growth.

41% of Store Openings were Dominated by LVMH, Kering and Richemont

Luxury groups are broadening their retail footprint, with a trend towards greater concentration. In 2021, 41% of all store openings were dominated by top three luxury houses, including LVMH, Kering and Richemont. Savills reported that this dominance is likely to increase further as these groups have increased their merger and acquisition activity over the past 12-18 months.

Savills gave a cautious outlook for the rest of 2022, indicating that fewer stores were likely to be taken than in the first half of the year due to the impact of the recent Chinese lockdown and rising inflation. “Combined with the geopolitical uncertainty generated by the terrible events in Ukraine, this might hamper investors in their acquisitions of new stores, although we think this will be a short-term issue, and the medium-term outlook remains positive,” Marie Hickey concluded.

Integrate In-store AR Digitalization for 3.5X Sales Growth

Looking further ahead, and from a store perspective, the biggest question is around online growth and what that means for boutique stores. The pandemic has accelerated online growth, but the majority of sales in 2021 (about 78%) continue to occur in-store. This highlights the ongoing importance of stores in promoting brand image and delivering a luxury experience, which also benefits online sales. Similarly, the evolution of the AR Metaverse as a way to deliver new revenue streams and engage Gen Z consumers, will also have a basis in the physical. Apply now to customize your AR digitalization solution for omni-channel growth.